10 Insurance Terms Every New Jersey Homeowner Should Know Before Filing a Claim

Introduction

Insurance policies are written in a language most people don’t speak—until they need to. For New Jersey homeowners, understanding the terminology behind your policy can mean the difference between a fully paid claim and a costly denial. This article breaks down ten essential insurance terms that every NJ homeowner should know before filing a property damage claim.

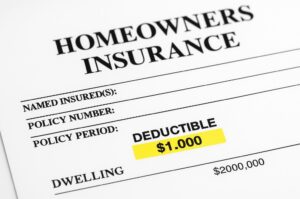

1. Deductible

The deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. In New Jersey, most homeowners policies use either a fixed dollar amount (e.g., $1,000) or a percentage-based deductible for wind or hurricane losses.

A higher deductible usually means lower premiums—but also higher out-of-pocket costs during a claim.

2. Actual Cash Value (ACV)

ACV refers to the depreciated value of damaged property at the time of loss. Carriers use this method to reduce payouts by accounting for age, wear, and market value.

Example: A 10-year-old roof damaged in a storm may only be valued at 40% of its original cost under ACV.

3. Replacement Cost Value (RCV)

RCV is the amount needed to replace damaged property with new materials of similar kind and quality—without subtracting depreciation.

Many NJ homeowners assume their policy pays RCV by default. However, this often only applies to structural components unless specifically endorsed for contents.

4. Endorsement

An endorsement is a written add-on that modifies your base policy. These can expand, restrict, or clarify your coverage.

Common NJ endorsements include:

- Sewer backup coverage

- Increased mold sublimits

- Ordinance or law coverage

- Equipment breakdown protection

5. Exclusion

An exclusion is something your policy does not cover. This could be specific types of damage, causes of loss, or classes of property.

Common NJ exclusions:

- Gradual or long-term water damage

- Neglect or lack of maintenance

6. Declarations Page

The declarations page (or “dec page”) is the summary sheet at the front of your policy. It lists:

- Named insured(s)

- Property address

- Coverage amounts

- Deductibles

- Endorsements

- Policy period

This is the single most important page to review after a loss.

7. Loss of Use / ALE

Additional Living Expenses (ALE)—also called Loss of Use—covers temporary living expenses if your home becomes uninhabitable.

Includes:

- Temporary housing

- Meals and laundry

- Mileage or transportation

8. Proof of Loss

A proof of loss is a sworn statement from the insured detailing damages and claimed amounts.

In New Jersey, failure to submit this on time can lead to claim denial.

9. Reservation of Rights

A reservation of rights (ROR) letter notifies you that your insurer is investigating the claim but may still deny it.

This is a red flag. Receiving an ROR doesn’t mean denial—but it means your claim is in question. Get professional advice ASAP.

10. Public Adjuster

A public adjuster (PA) is a licensed professional who represents you, not the insurance company, during a claim.

- NJ requires PAs to be licensed

- They work on contingency (typically 5–15%)

- Helpful for complex or large claims