Understanding Deductibles and Coverage Limits in New Jersey Homeowners Insurance Policies

Introduction

One of the most misunderstood aspects of a homeowners insurance policy is the deductible and how it interacts with coverage limits. For New Jersey policyholders, knowing the difference between what you’re insured for and what you’ll actually receive after a loss can prevent serious financial surprises.

This article breaks down the role of deductibles and coverage limits in property damage claims—using NJ-specific examples and considerations—so you can file with confidence.

What Is a Deductible?

A deductible is the portion of a covered loss that the policyholder is responsible for paying before the insurance company issues payment.

In New Jersey, homeowners commonly see two types:

- Flat deductibles (e.g., $500, $1,000, $2,500)

- Percentage-based deductibles for certain perils, such as hurricanes (typically 1%–5% of the dwelling coverage limit)

Example:

If you have a $1,000 deductible and suffer $12,000 in covered damages, your insurance company will pay $11,000. However, if the damage is valued at $900, you receive nothing, because the loss falls below your deductible.

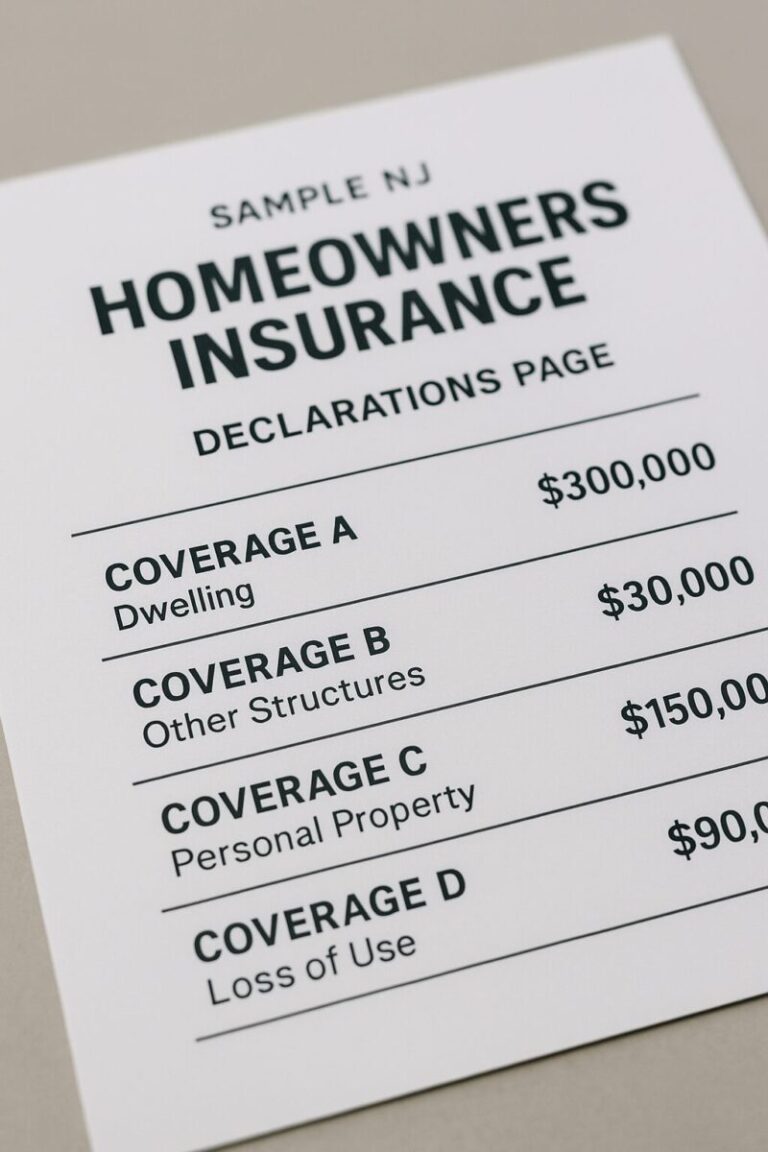

What Are Coverage Limits?

Coverage limits are the maximum amounts your insurer will pay for different types of losses.

These are set when your policy is written and appear on the declarations page.

Common NJ policy limits:

- Coverage A (Dwelling): Typically $250,000–$750,000

- Coverage B (Other Structures): Often 10% of Coverage A

- Coverage C (Contents): 50%–70% of Coverage A

- Coverage D (Loss of Use): 20%–30% of Coverage A

- Sublimits: Mold, code upgrades, jewelry, electronics

Hidden Pitfalls: Sublimits and Policy Caps

Sublimits apply to specific types of damage and can drastically reduce your recovery. Common examples in NJ:

- Mold coverage: Often capped at $10,000 or less

- Sewer or drain backup: Requires an endorsement, usually limited to $5,000–$10,000

- Code upgrade coverage (Ordinance or Law): Must be endorsed; otherwise repairs required by code may not be covered

Real-Life Scenario

Imagine this NJ claim:

- A pipe bursts in your second-floor bathroom while you’re on vacation

- Resulting damage: floors, ceilings, contents, and mold growth

- You have:

- $1,000 deductible

- $250,000 dwelling coverage

- Mold sublimit of $10,000

The insurer may:

- Pay $30,000 for structural repair (less deductible = $29,000)

- Limit mold remediation payout to $10,000 even if the actual cost is $25,000

- Deny contents you cannot prove ownership of

Understanding the Role of Depreciation

Even if your policy includes Replacement Cost Value (RCV), the insurer may initially pay Actual Cash Value (ACV)—with depreciation applied—and issue the balance only after repairs are completed.

For NJ homeowners, this means:

- You must front repair costs or financing

- You must submit invoices for RCV holdback to be released

Reviewing Your Policy Before You File a Claim

Before filing a claim in New Jersey, you should:

- Review your deductible and sublimits

- Identify percentage-based deductibles for storms

- Confirm endorsements for water backup, mold, and ordinance/law

- Know your coverage caps for contents and structure

Final Thoughts

Deductibles and coverage limits are the fine print details that make or break a claim. In New Jersey, where storm exposure and mold risk are significant, it’s essential to know not just what your policy says—but what it doesn’t.

Before damage occurs, review your policy thoroughly. And if a loss does happen, make sure your expectations match what the policy will actually pay.