Flood or Water Damage? The Costly Confusion That Trips Up NJ Homeowners Every Year

When water gets into your home, your first thought is usually: “Am I covered?”

Unfortunately, that’s one of the most misunderstood questions in all of home insurance — especially in New Jersey, where storms, plumbing leaks, and flooding can all look similar but are treated very differently by insurance carriers.

Knowing the difference between “flood damage” and “water damage” could save you thousands — or cost you your entire claim.

The Core Difference: Where the Water Comes From

Water Damage

Covered under a standard homeowners insurance policy.

It refers to sudden and accidental water losses originating inside the home — like:

- A burst pipe

- A broken washing machine hose

- A roof leak caused by wind or hail

- Water from a fire sprinkler or appliance overflow

These are typically covered because the cause is sudden and accidental.

Flood Damage

Not covered under standard homeowners insurance.

“Flood” is defined as water that enters your home from the ground up, affecting two or more properties or at least two acres of normally dry land.

Common flood causes:

- Storm surge or coastal flooding

- Overflowing rivers, creeks, or lakes

- Heavy rain pooling around the foundation

- Groundwater intrusion after a storm

To be covered, you need a separate flood insurance policy — either through the National Flood Insurance Program (NFIP) or a private flood carrier.

Why NJ Homeowners Are Especially Vulnerable

New Jersey’s mix of coastal towns, tidal rivers, and aging infrastructure makes it a perfect storm for confusion:

- Many areas outside FEMA’s official flood zones still experience flood-like events.

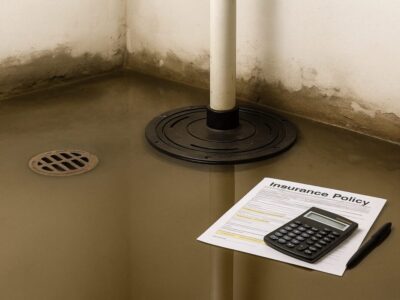

- Sump pump failures and sewer backups fall into gray areas where coverage depends on specific endorsements.

- Homeowners often assume “if it’s water, it’s covered.” It’s not that simple.

Real-World Example

After a Nor’easter, a homeowner in Ocean County found two inches of water in their finished basement. They filed a claim expecting coverage — only to learn it was classified as flooding, not water damage.

Because they didn’t carry flood insurance, the $40,000 in repairs were denied.

How to Protect Yourself

The Bottom Line

When it comes to insurance, not all water is treated equally.

A simple misunderstanding of “flood” versus “water damage” can mean the difference between a covered loss and an empty payout.

If you live in New Jersey, where heavy rain, coastal storms, and old plumbing collide, reviewing your coverage today could save you tens of thousands later.