The Deductible Surprise That Could Cost NJ Homeowners Thousands

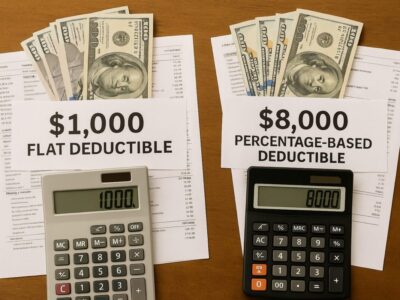

Most New Jersey homeowners think of their insurance deductible as a flat number — usually $500 or $1,000. But hidden deep in many policies are special deductibles that can leave you paying far more out of pocket than you ever expected.

If you don’t know how your deductible really works, you could be in for a costly surprise when it’s time to file a claim.

What Exactly Is a Deductible?

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible and suffer $10,000 in covered damage, you’ll pay the first $1,000 and the insurance company will cover the remaining $9,000.

But here’s the catch: not all deductibles are created equal.

The Hidden Deductible Traps in NJ Policies

1. Percentage-Based Deductibles

Instead of a flat $1,000, some policies use a percentage of your home’s insured value.

- A 2% deductible on a $400,000 home = $8,000 out of pocket.

- A 5% deductible = $20,000 out of pocket.

This can be a devastating surprise for homeowners who assumed they had a small, fixed deductible.

2. Separate Wind, Hail, and Hurricane Deductibles

In coastal states like New Jersey, insurers often include higher deductibles for storm damage. You may have one deductible for fire or theft, but a completely different (and much higher) deductible if your roof is damaged by a hurricane or nor’easter.

3. Named Storm Deductibles

Some policies kick in a special deductible only when the National Weather Service officially names the storm. That means damage from “Tropical Storm Alex” could trigger a separate, higher deductible.

4. Per-Claim vs. Per-Occurrence Deductibles

Certain policies apply deductibles per claim, while others apply them per event. This distinction can make a big difference when multiple areas of your property are damaged in one storm.

Real-World Example

A homeowner in Ocean County thought they had a $1,000 deductible. After Superstorm Sandy, they learned their policy had a 5% hurricane deductible. On their $350,000 home, that meant paying $17,500 before the insurance even began to cover the loss.

How to Avoid the Deductible Shock

✔ Read your Declarations Page carefully to see if you have flat or percentage-based deductibles.

✔ Look for special deductibles related to wind, hail, or hurricanes.

✔ Ask your agent about “named storm” clauses and how they affect your out-of-pocket cost.

✔ Review your policy annually — as rebuilding costs rise, percentage-based deductibles also increase.

The Bottom Line

Deductibles aren’t always as straightforward as they seem. If your policy includes percentage-based or special deductibles, you could end up paying thousands more than you expected after a major loss.

Understanding the fine print today can prevent financial heartbreak tomorrow.