The Shocking Truth About How Insurance Companies Lowball Claims (And What You Can Do About It)

If you’ve filed a property damage claim in New Jersey and the insurance company’s offer felt way too low, you’re not imagining it. This is a homeowners insurance lowball estimate.

Lowballing is a common tactic insurers use to protect profits. From underestimating repair costs to excluding key line items, the system is stacked against homeowners who don’t know how to push back.

In this article, we reveal exactly how carriers cut corners on scope and pricing—and what you can do about it.

What Is a “Lowball” Offer?

A lowball offer is when the insurer provides a settlement that is:

Below actual repair costs

Missing required scope items

Using outdated or inaccurate pricing

Ignoring specialized trades or materials

It’s not always labeled as a denial—but the underpayment can leave you with thousands in out-of-pocket expenses.

5 Ways Insurance Companies Lowball Claims

1. Incomplete Scope of Work

Adjusters may leave off critical repairs like:

Painting undamaged areas for uniformity

Removing and resetting fixtures

Code-required upgrades (if not endorsed)

2. Using Outdated Pricing Software

Carriers often rely on estimating software (like Xactimate or Symbility), but don’t update local pricing for:

Labor shortages

Inflation

Material spikes (like lumber or drywall)

Result: You’re offered less than what it actually costs to do the job.

3. Third-Party Reviews & Desk Adjusting

Carriers frequently send your estimate to platforms like:

Alacrity

Sedgwick

Pilot or Crawford

These firms are incentivized to cut costs, not approve full scope. You may never speak to a licensed adjuster at all.

4. Over-Depreciating or Misclassifying Materials

Example: Hardwood floors labeled as “laminate”

Or: 20-year depreciation applied to items less than 10 years old

This tactic reduces Actual Cash Value (ACV) and delays full Replacement Cost Value (RCV) payout.

5. Blaming Pre-Existing or Long-Term Damage

Carriers often argue damage is due to:

Wear and tear

Maintenance issues

“Gradual leakage” or long-term mold

Unless you prove sudden accidental loss, they may deny that portion of the claim.

What You Can Do About It

If you’re facing pushback or a suspiciously low estimate, here’s how to take control:

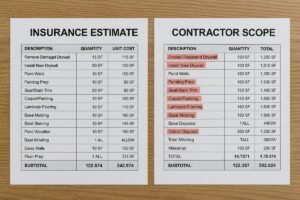

Get a Competing Estimate

Get a Competing Estimate

Have a licensed contractor or public adjuster write a detailed estimate including:

- Full scope of repairs

- Photos and diagrams

- Xactimate or similar pricing

- Code references (if needed)

Demand Justification in Writing

Demand Justification in Writing

Ask the carrier to explain, in writing:

- Why certain items were excluded

- How pricing was calculated

- Who reviewed the claim and when

This often forces a more careful review.

Submit a Rebuttal with Documentation

Submit a Rebuttal with Documentation

Include:

- Photos of all damages

- Expert opinions

- Manufacturer specs or repair standards

- Local material and labor invoices (if available)

Make it harder for the carrier to dismiss your evidence.

Escalate Strategically

Escalate Strategically

You can escalate to:

- A claims supervisor

- The carrier’s internal review board

- The NJ Department of Banking & Insurance (DOBI)

- A licensed public adjuster or attorney

Don’t rely solely on customer service reps—they don’t make payment decision

Final Thoughts

Carriers don’t always deny claims outright—sometimes, they underpay quietly and hope you’ll accept it.

Understanding their tactics is the first step to fighting back. With solid documentation, expert support, and persistence, you can recover what you’re actually owed.